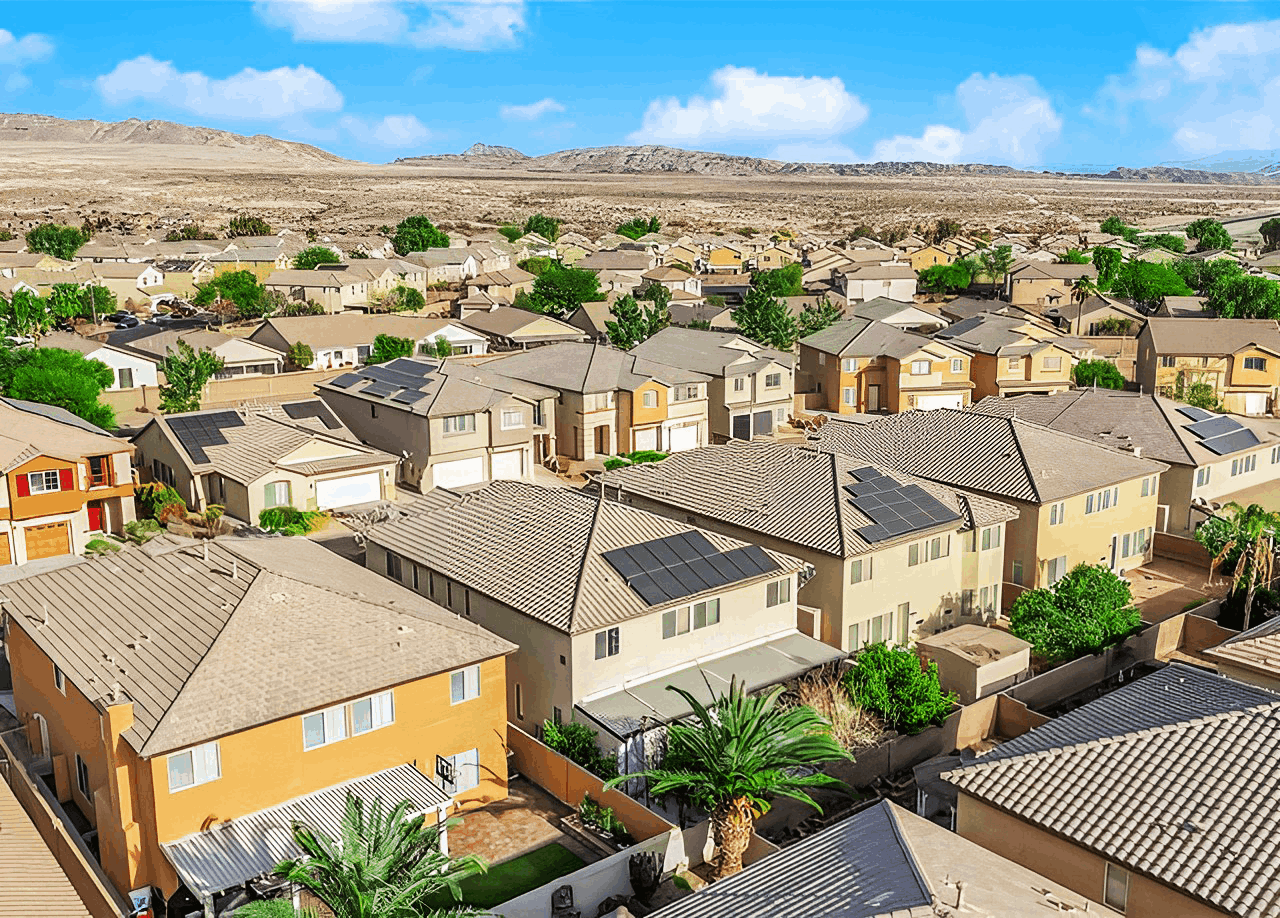

When Will Home Prices Finally Ease?

The dream of homeownership remains a cornerstone of financial security, but for many, rising home prices have put that dream out of reach. The question on many people’s minds is: when will home prices finally start to ease up? While it’s tempting to hope for a sudden crash in prices, experts suggest that’s unlikely. Instead, any meaningful reduction in prices will require a combination of key economic and market factors aligning over time.

The Core of the Issue: Supply vs. Demand

The housing market is fundamentally shaped by the forces of supply and demand. For prices to come down, the number of homes available for sale needs to meet or exceed the number of buyers looking to purchase. Unfortunately, the United States is facing a housing shortage of historic proportions. Estimates suggest the country is several million homes short of what’s needed to balance the market. This imbalance keeps competition fierce among buyers, driving prices up even when other economic conditions might suggest otherwise.

How Did We Get Here?

The roots of today’s housing shortage go back more than a decade. After the 2008 housing crisis, homebuilders pulled back significantly on new construction. The crisis not only reduced demand temporarily but also caused widespread caution in the construction industry. As a result, the number of new homes built each year lagged far behind the pace of household formation.

Even as the economy recovered, construction remained sluggish. Rising costs for labor, materials, and land made it more expensive for builders to develop new homes, particularly in the affordable housing segment. By the time builders started ramping up production in recent years, the gap between supply and demand was already enormous.

What Needs to Happen for Prices to Decline?

Bringing home prices down isn’t an overnight process—it requires addressing the core factors driving the imbalance:

- Increasing Housing Supply

For prices to stabilize or decline, more homes need to be available for purchase. This can happen through new construction, existing homeowners listing their properties, or a combination of both. However, building more homes is a slow and complex process. Builders are still catching up from years of underproduction, and challenges like zoning restrictions, high construction costs, and labor shortages continue to slow progress. - Easing Buyer Demand

If fewer people are actively looking to buy, competition for homes will decrease, and prices will stabilize. Rising mortgage rates are one factor that could temper demand, as higher rates make monthly payments less affordable for buyers. Additionally, economic conditions, such as slower wage growth or an increase in unemployment, could reduce the number of active buyers in the market. - Government Intervention

Policy changes could play a significant role in addressing the housing crisis. For example, incentives for affordable housing development, relaxed zoning laws to allow for higher-density housing, and tax breaks for builders focused on entry-level homes could all help boost supply.

Why Prices Aren’t Likely to Crash

While the idea of a housing market crash might seem appealing to buyers waiting for lower prices, the current market conditions make this scenario unlikely. Crashes typically occur when there’s an oversupply of homes relative to demand, as was the case during the 2008 crisis. Today, the opposite is true—demand far outstrips supply, which serves as a buffer against steep price declines.

What Does the Future Hold?

Most experts agree that while home prices may not drop dramatically, the pace of price increases is likely to slow over the coming years. Some markets with higher inventory levels or lower demand may see slight price declines, but this won’t be the norm nationwide. Instead, price growth is expected to become more modest, providing some relief for buyers.

Local Market Variations

It’s important to remember that real estate markets are highly localized. What happens nationally may not reflect the conditions in your area. For example, markets with significant new construction or a slowing economy may see more noticeable price adjustments. In contrast, areas with strong job growth and limited housing inventory will likely continue to see rising prices.

The Bottom Line

Easing home prices requires addressing the supply-demand imbalance that’s been years in the making. This will take time, coordinated efforts, and changes in both market behavior and public policy. While prices may not crash, buyers can expect slower growth rates and more opportunities to enter the market as conditions gradually improve.

To understand what’s happening in your specific market, it’s crucial to work with a local real estate expert. They can provide insights into inventory levels, demand trends, and opportunities that fit your budget and goals.

Recent Posts