How to Buy a Home Now—Without Waiting for Interest Rates to Drop

Many homebuyers hesitate to enter the market, hoping for lower interest rates before making a move. While lower rates can reduce monthly payments, waiting may mean missing out on the right home, rising home prices, and valuable incentives available today. Instead of delaying, consider these smart

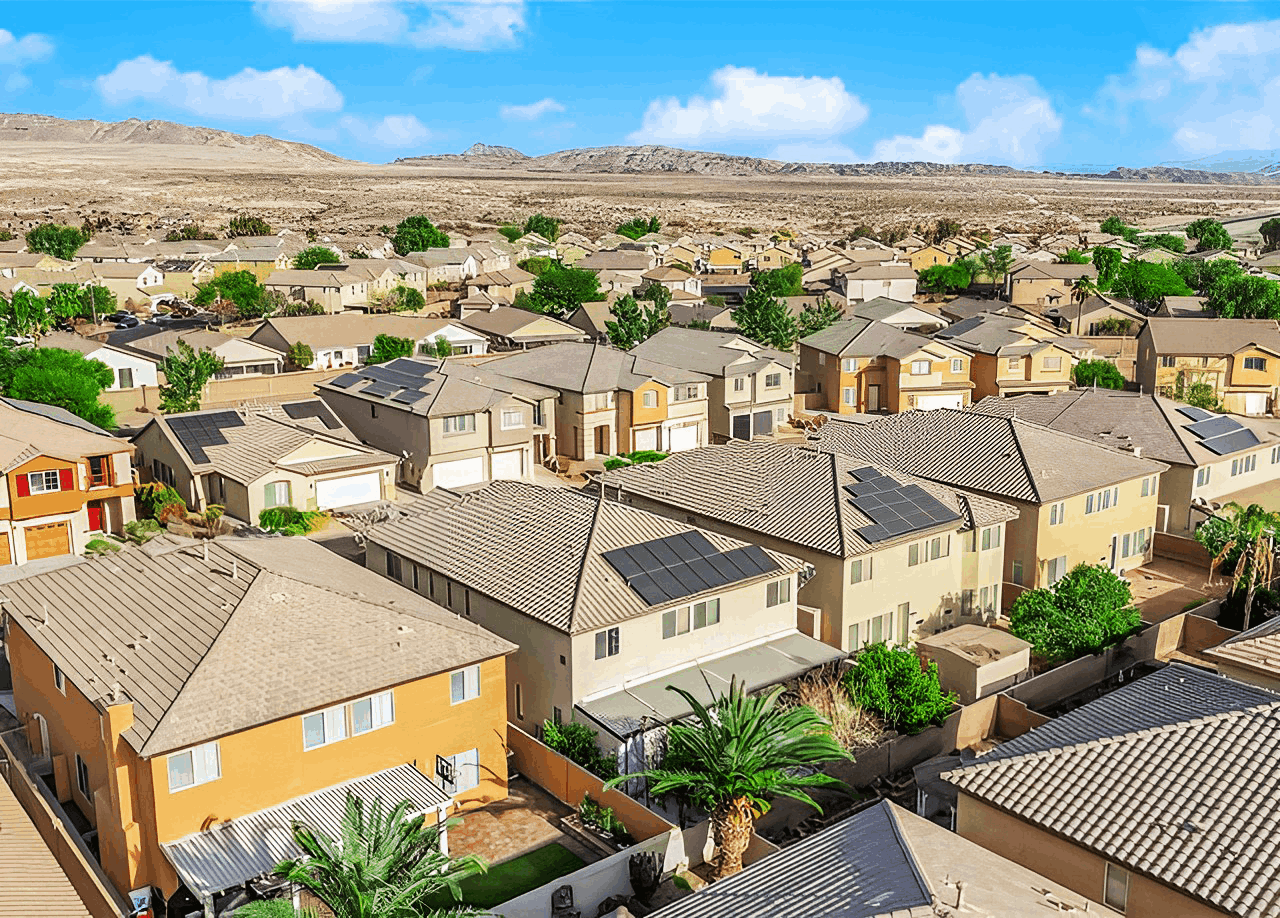

2025 - A Guide to Short-Term Rentals and Airbnb Regulations in Las Vegas, Nevada

Short-term rentals have become a popular investment opportunity in Las Vegas and Henderson, attracting both homeowners and real estate investors. However, strict regulations govern short-term rentals, and failure to comply can result in significant fines or legal action. Whether you're an investo

When Is the Best Time to Sell a Home? A Seasonal Breakdown

Timing the sale of your home can make a significant difference in how quickly it sells and the price you receive. The Las Vegas real estate market has seasonal trends that can impact buyer demand, competition, and home prices. Whether you're looking to sell quickly or maximize your return, unders

Recent Posts